Registering a inherited property in Spain with the Property Registry

What documents are necessary to register an inheritance in the Property Registry?

After the death of a loved one, and once the period of mourning is over, the heirs must face the no less complicated task of bureaucratic procedures: declarations, awards, taxes … If you find yourself, unfortunately, immersed in a situation like This, you must know what are the necessary documents to register an inheritance in the Property Registry.

When a person dies, they can do so with or without having made a will. In any of the cases, after the declaration of heirs and the adjudication of the inheritance, the corresponding taxes must be paid or, where appropriate, present the exempt tax model. It is advisable, in case of the existence of real estate, to register the inheritance in the Registry. Do not panic! Here we shed some light on this procedural hubbub.

Why register an inheritance in the Property Registry?

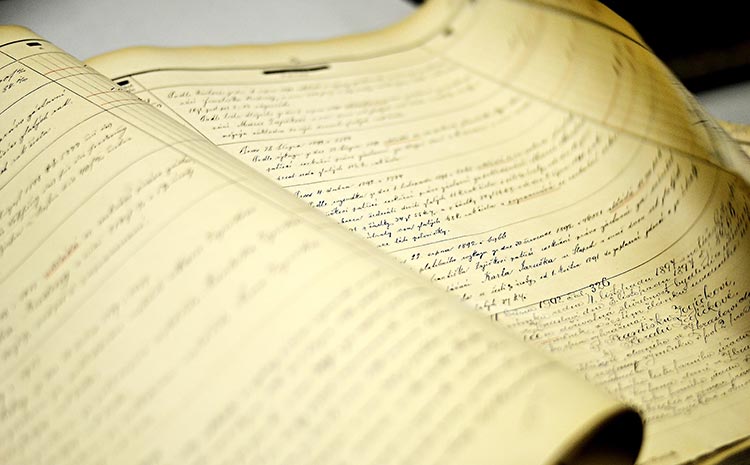

The Property Registry is a public body whose main objective is to give legal certainty to the existing reality regarding real estate. Its books include the modifications on the domain, real rights or charges of a property, as well as its owners and other important data to preserve the publicity of this relevant information in legal traffic. If you do not register the real estate of the inheritance, you could have problems in the future with any operation related to the property.

In Spain, unlike other laws, registering a home or premises in the Property Registry is voluntary. However, if you are an heir in any case where there is real estate, it is important to register this inheritance in the Property Registry since, otherwise, it would be unprotected against third parties who act in good faith. In addition, the Registrar will verify and attest to all the documentation of the inscribable property, which gives greater security and evidentiary efficacy.

Documents to register an inheritance in the Registry

The Registrar will require the presentation of these documents before registering your inheritance in the Property Registry:

- Death and Last Wills Certificates of the owner of the property to be registered, which must already have to process the inheritance from the beginning, especially in the notarial declaration of heirs.

- Inheritance Tax payment letter.

- If there is a will, you will have to present a notarial instance that contemplates the assets to be registered, if you are the only heir; or an inheritance award deed, where the distribution of assets of the same appears, as well as its valuation.

- If there is no will, you must prove your status as an interested party with a notarized declaration of heirs and the corresponding award deed, if applicable.

From there, the Registry will have 15 days to register your inheritance or, where appropriate, notify the interested party (you) of the problems that prevent the registration and the correction period. You can verify that the property has been registered in your name and that the data is correct by requesting a Simple Note from the same Property Registry. If you have not done so, and you want to make sure, RegistroDirecto can request this document for you, or the more complete Registration Certification. Because any guarantee can fall short …

Not registering an inheritance in the Registry is practically foolhardy. Doing so, in addition to the special legal protection it grants, may allow you to mortgage the property, among other advantages. Benefits that, due to the low cost that the operation entails, strongly advise us to register the inheritance in the corresponding Property Registry. Remember that today’s world is constantly changing, and if 50 years ago a handshake served as a proof of commitment, today we must take more care of the formality of any act. In the legal world, don’t settle for the word!